Investment Real Estate in Japan

Investment Real Estate in Japan

Investment real estate in Japan is mainly classified in three categories: buildings/apartments, condominium apartments (family and one-room), and land.

YCM’s focuses on one-room condominium apartments.

One-room condominium apartments are in high demand in Japan because of their unique floor plans, and are also extremely popular as investment properties, because they earn better profits than other types of buildings, apartments, and land etc. Another feature of investing in one-room condominiums is that as a result of their popularity, they can be sold for high profits, so that barring an extraordinary change of circumstances, investors rarely suffer a loss when they eventually sell them.

A merit of purchasing real estate in Japan is that an investor can not only obtain a private use section, but can semi-permanently own a proportional share of the building site.

Forms of land ownership vary between countries. In some, ownership rights to land cannot be obtained, or they are purchased by period of use or organizations, but the biggest benefit of Japan is that an investor can personally own the land.

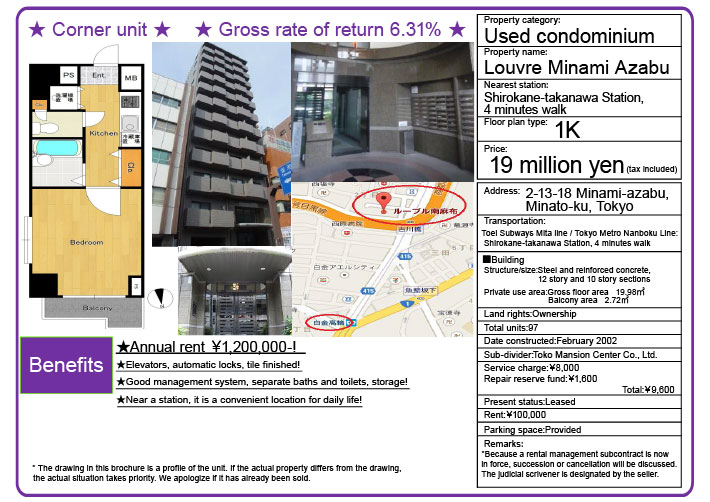

Example of a one-room condominium in Japan

Now is the time to buy a one-room condominium apartment in the Tokyo region of Japan

Changing prices of used one-room condominium apartments in the Tokyo region.

▼Now, when prices are reasonable, you can easily recover your investment.

The purpose of real estate investing in Japan is income gains; not capital gains. The recent Lehman Shock and Great East Japan Earthquake, reduced prices, lowering the hurdle to investment in real estate in districts with high brand value such as the Ginza, Shinjuku, and Shibuya districts of Tokyo. Although these are in the Tokyo region, quite a number of real estate properties can provide investment return of 10%, and can be managed efficiently so that rent payments can recover the investment in from 7 to 10 years.

▼As an effect of the Tokyo Olympics, investors can also count on future capital gains in the Tokyo region

As you can see from the following diagram, the market prices of Japanese real estate are now low, but under the impact of the Tokyo Olympics which will be held in 2020, real estate prices are certain to rise.

This means that the Japanese real estate market will present good opportunities to earn profits through a variety of approaches such as capital gains and income gains.

Is the best time to operate a condominium apartment when the yen is rising or when the yen is falling?

Abenomics was introduced in November 2012. The economy has been seriously impacted, driving the U.S. dollar – yen exchange rate rapidly from a little over 75 yen to over 103 yen in about half a year: a major shift from a rising yen to a falling yen. In the summer of 2013, many large Japanese corporations increased their bonuses and an optimistic view—the opinion that the economic environment had begun to improve—was heard. Is the best time to invest in real estate in Japan when the yen is rising or when the yen is falling?

The prices of shares and of real estate are closely correlated in Japan. If corporate economic activities pick up, many people and assets are naturally attracted to the center of economic activities, pushing up the price of land. In Japan, which is a country with narrow habitable land, and particularly in the Tokyo region which boasts the world’s largest economy, land demand grows faster than supply, strengthening this correlation.

But real estate yields large amounts of money when it is bought and sold, so real estate trends form curves gentler than those representing exchange rates or stock prices both during economic growth and when growth stalls.

This means that if you buy real estate, the price will fall while the yen rises. It can also be stated that real estate is sold when the yen is falling and real estate prices are soaring.

And to further focus timing, because yen exchange rates are correlated with Japan’s real estate prices and appear to tend to lead them, it can be stated that for overseas investors, the time to purchase is when a rising yen has just changed to a falling yen but real estate prices have not yet risen. And inversely, the time to sell is when a falling yen has just changed to a rising yen but real estate prices have not yet fallen.

In fact, beginning in the spring of 2013, foreign real estate investors who had noticed rising share prices in Japan rushed to buy real estate in the Tokyo region.

But this was a result of the capital gains approach: earning based on profits earned by dealing in land. Capital gains can bring huge earnings, but in the same way, result in huge losses. An investor will naturally earn profits if the yen falls after the investor purchases a condominium apartment, but inversely, if the yen rises, the investor can suffer a loss. Even an investor that purchases a condominium apartment when the yen is low must have a clear exit strategy that can be followed whether the investor’s aim was income gain or capital gain.

In Japan, investment in one-room condominium apartments is a financial product intended to earn fixed rental income over the long term. It conforms to a concept called income gains where assets grow more reliably than under the capital gains approach, which is subject to sharp changes in asset conditions in the short term. This means that profits are almost the same when the yen is falling and when it is rising. This is a major attractive feature of investing in condominium apartments. If the yen falls after an investor has purchased a condominium apartment, the investment may well earn higher rental income than originally expected.

Inversely, even if the yen rises, rents will not fall as remarkably as exchange rate or share prices. Rather, since the past period of high speed economic growth, rents have almost never fallen in the one-room condominium apartment field, which is characterized by high demand in good districts of the Tokyo region.

Solid profits from stable rents

Changes of rents in one-room condominium apartments in the Tokyo region

As reported in various media, concentration in the center of the city is a conspicuous trend.

Fluctuating rents is one risk of real estate investment. Past results are the key word and verify stability.

One-room real estate investment with YCM

YCM focusses on one-room condominium apartments described by the following items

[1] Located in the 23 wards of Tokyo and in Yokohama and Kawasaki

[2] Buildings constructed 15 years ago

[3] Prices ranging from 10 million to 20 million yen

Properties that fit the above description are a high rental demand area important for real estate investment. In this area, even if a unit is vacated, the rent is quickly recovered.

Here is a reference example of the properties that YCM handles.

Changing rents of one-room condominium apartments purchased as investments

In the above example, initial return of 6.32% is obtained when the unit is purchased for 19 million yen.

It is predicted that estimated return of 5.74% will be ensured 20 years later.

YCM handles many properties of this kind.

*The figures in the graph are estimates; then are not guaranteed values.

Strengths of YCM

YCM applies its proprietary sales methods to sell properties on behalf of customers including both private individuals and corporations. A strength of YCM is that it creates win-win relationships between seller, buyer, and YCM by, instead of purchasing such properties, directly introducing its sellers to buyers.

YCM has already introduced its own proprietary lease management system to provide post-purchase follow-up services, letting owners receive stable real estate income while remaining in their home countries.

YCM can perform lease management on your behalf after the contract is completed and the purchase price paid, lowering your burden to simply obtaining documents.

Please do not hesitate to contact us to discuss your needs.